With New Zealand having officially declared a recession, it’s only natural to be wondering whether the Australian economy is headed the same way in 2023. Keeping that in mind, it’s important to answer some of the big questions: what exactly is a recession, is Australia headed towards one, what would it mean for your financial situation, and how can you recession-proof your life?

What is a recession?

While there is no official definition of a recession, a technical recession is defined as two consecutive quarters of negative growth in a country’s gross domestic product (GDP). By this definition, Australia has not experienced a recession since the 1990s for various reasons. This is largely a result of the volatility of GDP, which can be weak without economic growth stopping altogether.

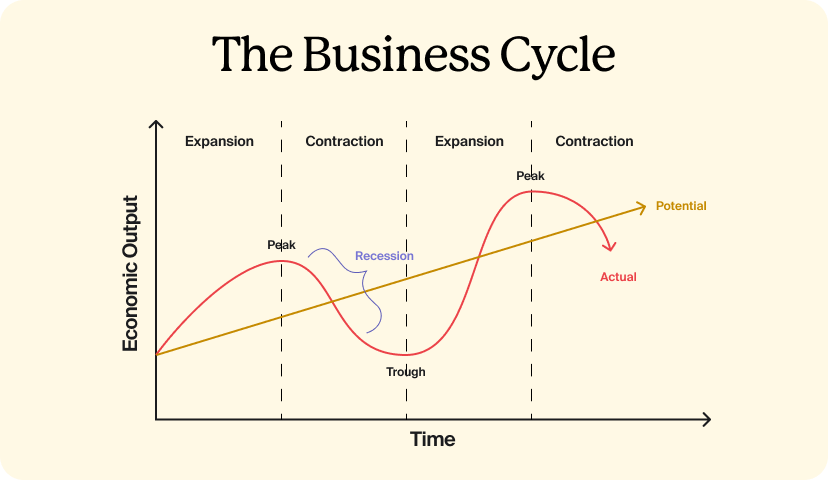

The business cycle — wherein the economy cycles between peaks and troughs of economic output over time — naturally incorporates recessions. Naturally, between an economic high point and a trough comes a recession. However, these vary in intensity and duration and can go from minor slowdowns to full-blown depressions.

Most people would consider periods like the Global Financial Crisis (GFC) as a short-term economic downturn representative of a recession, though it doesn’t meet the technical requirements in Australia. Australia may have fared better than other economies, but there was still a considerable slowdown in the economy for a sustained period of time.

When talking about a recession, we’re considering an economic downturn that is not a one-off occurrence but a reflection of a consistent downturn in economic output. When this continues for an even longer period of time, we’d be talking about a depression — commonly associated with the Great Depression of the 1930s.

Is Australia heading for a recession?

Before a recession, we tend to see examples of:

- High interest rates and dramatic rate hikes

- Increased unemployment rates

- Stagnant or declining wages

- Low consumer confidence

- Notable crashes or losses on the stock market

- Decreases in household spending

- Company shutdowns

- Rising inflation

- Supply chain disruptions

- Market collapses — like the property market crash preceding the GFC

- Debt ballooning out of control.

Much of this lines up with current conditions in the Australian market, with economists already noting this post-pandemic period of time as a downturn in the economy beyond ordinary slowdown. What is occurring now is definitely a significant slowdown in economic growth, but the central banks have not flagged it as a recession.

In the current wake of the COVID-19 pandemic, we are in a continually unfolding financial situation, and it’s difficult to say what will happen to the economy over the next year.

While New Zealand declaring a recession might tend to indicate that Australia is headed in the same direction, it is also important to note that New Zealand has a much smaller economy than Australia, far more prone to short-term volatility and that Australia’s economy has shown in the past to be quite resilient in the face of the global financial crisis.

What happens during a recession?

During a recession, with so many factors putting financial strain on a population, the goal of central banks and financial institutions becomes re-adjusting to try and restore some semblance of balance. Recessions are a necessary part of business cycles, they put people under a tremendous amount of pressure, and action is needed from central forces to help maintain balance.

Before a recession is officially declared, we could see conditions worsen in several key areas. Cost of living challenges are likely to continue, with more rate rises on the horizon as the Reserve Bank of Australia (RBA) attempts to slow inflation. If this is unsuccessful, we could instead see housing repayments becoming unmanageable for many, emergency funds being drained, and increased dependence on debt products (like personal loans and credit cards). Since another marker of a recession is increased unemployment, we also tend to see widespread job loss and a general movement towards austerity.

The response of the RBA and central banks to a recession is generally to begin to cut rates and to find ways to inject money back into the economy. Things we have seen in Australia in the past include stimulus packages, tightened policy, and working to prevent the collapse of banking institutions. The drop in rates does tend to keep housing repayments down but also means that savings accounts and term deposits become less profitable.

Small perks for those who are secure in their finances: a recession usually comes with decreased asset prices, which is good for those on the property market or would-be investors.

How can I protect myself from a recession?

Since a recession will have a wide-reaching impact across all markets, your financial situation is likely to be impacted regardless of what you do with your money. However, there are ways you can better prepare yourself against the biggest risks and do some work to recession-proof your finances, like:

- Creating an emergency savings fund: Though interest rates on any savings account will be lower during a recession, having an emergency fund can prepare you in case you suddenly need money or become a victim of rising unemployment rates.

- Minimising risk and diversifying investments: If you are an investor or enjoy playing the stock market, consider switching up from your usual portfolio to something less risky. Since markets can have the potential to crash, you might want to keep your money in a variety of different places. As a disclaimer, there is a level of risk associated with any form of investment, so while diversification is a strategy, it is not foolproof.

- Work on your credit score: Since many people become borrowers during recessions, you’ll want to do whatever work you can to get your credit score in tip-top condition. This can make it easier for you to get approval from lenders for products like credit cards or personal loans. Do this by paying off any outstanding debts and getting ahead on any repayments.

If you’re concerned about how an oncoming recession or economic downturn may impact your finances, you may want to seek specific financial advice.